Bad Debts & GST Relief[]

Recording debt that cannot be recovered after six (6) months[]

- Go to Sales --> Lists --> Invoice List

- Select the Period Range of the Bad Debt Invoice

- The optional selection is Customer, Project, Department, Sales Person and Status. These options are just optional and help the system to narrow down your search.

- Click Search

- Click the 'Alter' icon to change the Invoice status

- On the bottom of the page, click on the 'End Transaction' button

- A pop-out message will appear to confirm your selection, click 'OK'

- The status of the invoice will change from 'Open' to 'Closed'. A closed transaction journal entries will remain recorded while the invoice will remain as closed, unable to receive payment or be voided.

Recording GST relief to be claimed[]

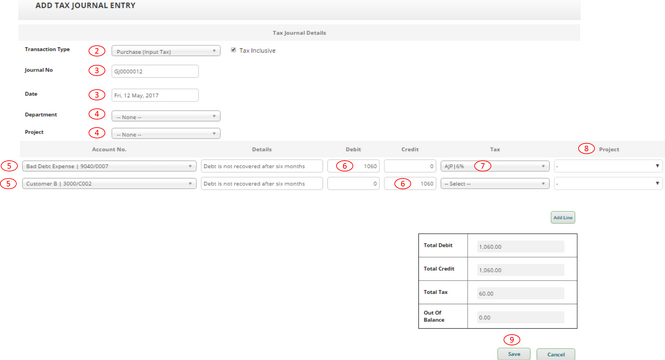

- Go to Accounting --> New Tax Journal Entry

- Transaction type select “Purchase (Input Tax)”

- Fill in Journal No., select the Date

- Select Department and/or Project if applicable

- The two accounts to be selected are Bad Debt (Expense Account) and the particular Debtor Account (Asset Account). Create a new account if they are not available.

- The amount for Bad Debt Account is on Debit side whereas the amount for the Debtor Account is on the Credit side. These two amounts shall be same and GST-inclusive

- Select AJP 6% as the tax for only Bad Debt Account. For the Debtor Account, don’t need to select tax.

- Select Project if applicable

- Click “Save” and it is done!

Bad Debt Recovery[]

Recording the recovery of a bad debt[]

- Go to Accounting --> New Tax Journal Entry

- Transaction type select “Sales (Output Tax)”

- Fill in Journal No., select the Date

- Select Department and/or Project if applicable

- The two accounts to be selected are Bank Account (Asset Account) and Bad Debt Recovery (Revenue Account). Create a new account if they are not available.

- The amount for Bank Account is on Debit side whereas the amount for Bad Debt Recovery is on the Credit side. These two amounts shall be same and GST-inclusive

- Select AJS 6% as the tax for only Bad Debt Recovery. For Bank Account, don’t need to select tax.

- Select Project if applicable

- Click “Save” and it is done!

Doubtful Debt[]

Recording Doubtful Debts[]

How to record doubtful debts, which are the debt that is unlikely to be able to collect

- Go to Accounting New Journal Entry.

- Fill in Journal No., select the Date, and do not tick the “This is an auditor edited journal entry”

- Select Department and/or Project if applicable

- The two accounts to be selected are Allowance for Doubtful Debts Adjustment (Expense/Revenue Account) and Allowance for Doubtful Debt (Asset Account). Create a new account if they are not available.

- If the doubtful debts for this year increase (decrease), the amount of Allowance for Doubtful Debts Adjustment is on Debit (Credit) side whereas the amount for Accumulated Depreciation Account is on Credit (Debit) side. These two amounts shall be same.

- Select Project if Applicable

- Click “Save” and it is done!

Asset Depreciation[]

Recording Fixed Asset Depreciation[]

How to record depreciation for a fixed asset (the depreciation amount depends on the depreciation method)

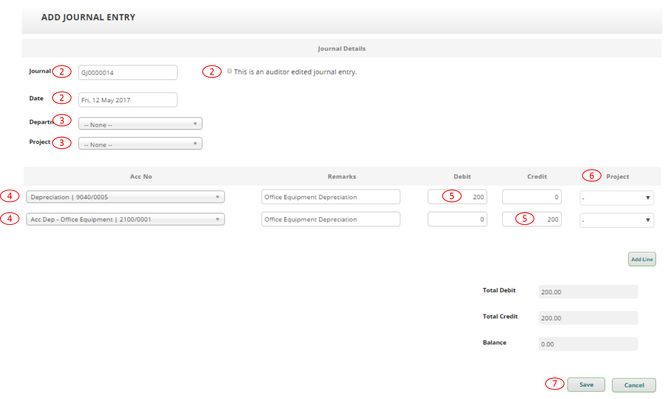

- Go to Accounting --> New Journal Entry

- Fill in Journal No., select the Date, and do not tick the “This is an auditor edited journal entry”

- Select Department and/or Project if applicable

- The two accounts to be selected are Depreciation Account (Expense Account) and [Particular Fixed Asset]’s Accumulated Depreciation Account (Asset Account). Create a new account if they are not available.

- The amount for Depreciation Account is on Debit side whereas the amount for Accumulated Depreciation Account is on the Credit side. These two amounts shall be same.

- Select Project if Applicable

- Click “Save” and it is done!

Directors’ Claim[]

Recording Expense Paid by Director[]

How to record expenses paid by Directors

- Go to Purchases --> Purchase Invoice

- Select the payee as the Vendor. Use the “Quick Add New Contact” to add contact for the payee if it is not in the Vendor list

- Select invoice date, and fill in Purchase Invoice No. and, if applicable, Shipping Date

- Select Department and/or Project if applicable

- Fill in Import Declaration No. if applicable

- Select the corresponding expense account for Misc Entry. If the expense account is not available, go to Chart of Accounts to create a new account for the expense.

- Click Add Misc Entry.

- Fill in the information of the expense, including description, quantity, price, etc.

- Select appropriate tax code, e.g. TX 6%, for tax.

- Select Project if applicable

- Tick “Tax Inclusive” if the price above is tax-inclusive

- Select Account Payable for Payment / Posting Method

- Remain Trade Account as the Vendor’s account

- Attach document if necessary

- Click “Post” and “OK".

Making Payment from Director's Account[]

- Click the Payment Icon for the purchase invoice to go to the Payment page

- Select the vendor and Amount due to Director account for payee and payer respectively

- Select Payment Date, and fill in Payment Details and, if applicable, Cheque No.

- Fill in the Amount paid

- Click “Process Payment” and it is done!

Recording Claims Paid to Director[]

How to record claims paid to Directors via Journal Entry

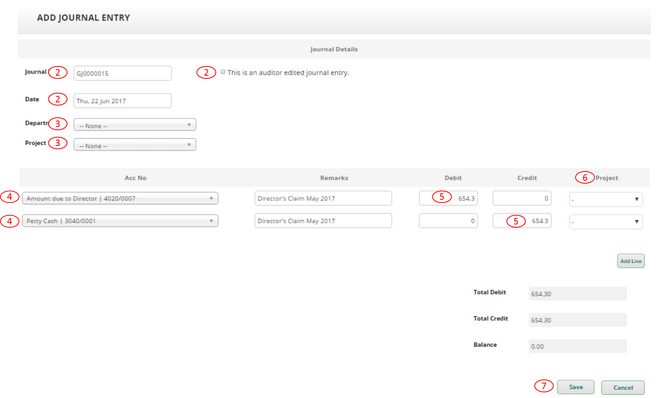

- Go to Accounting --> New Journal Entry.

- Fill in Journal No., select the Date, and do not tick the “This is an auditor edited journal entry”

- Select Department and/or Project if applicable

- The two accounts to be selected are Amount Due to Director (Liability Account) and Bank/Cash Account (Asset Account). Create a new account if they are not available.

- The amount for Amount Due to Director is on Debit side whereas the amount for Bank/Cash Account is on the Credit side. These two amounts shall be same.

- Select Project if Applicable

- Click “Save” and it is done!